In the competitive world of trading, having a broker that supports advanced strategies is crucial for professional traders. This review dives into how ADSS, a prominent execution-only broker, supports advanced trading strategies. We will explore their platform capabilities, tools for specific strategies, risk management features, and the quality of their customer support tailored for sophisticated trading needs. Understanding these aspects will help traders evaluate whether ADSS meets their advanced trading requirements.

Advanced Trading Features

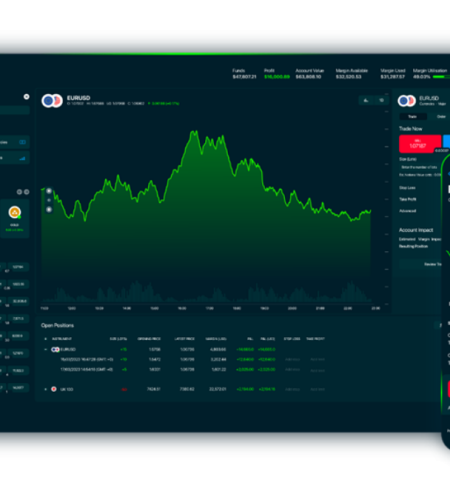

ADSS’s trading platforms are designed to cater to the needs of advanced traders. They offer robust tools and technology that enhance trading efficiency. The platforms are equipped with advanced charting capabilities, allowing for detailed technical analysis. Custom indicators can be added, and traders can create complex chart setups to fit their strategies. The execution speed is optimized for high-frequency trading, ensuring minimal latency and swift order execution. For traders relying on algorithmic trading, ADSS provides API access, allowing for seamless integration with automated trading systems.

Charting and Technical Analysis

The charting tools available on ADSS’s platforms are comprehensive and customizable. Traders can choose from a variety of chart types and apply numerous technical indicators. The ability to customize charts and indicators is crucial for advanced traders who rely on detailed technical analysis. The platforms also offer features like multiple time frame analysis and advanced drawing tools, which are essential for developing and executing sophisticated trading strategies.

Execution Speed and Reliability

Execution speed is a critical factor for advanced traders, especially those involved in high-frequency trading. ADSS boasts low latency and reliable order execution, which are essential for maintaining trading efficiency and accuracy. The broker’s infrastructure supports rapid execution, reducing the risk of slippage and ensuring that orders are filled at the desired price.

Support for Specific Advanced Strategies

ADSS excels in accommodating various advanced trading strategies, offering specialized tools and features to meet the needs of sophisticated traders.

Algorithmic Trading

For traders utilizing algorithmic trading strategies, ADSS offers significant support. The broker’s platforms are compatible with automated trading systems, and the available APIs facilitate the development and deployment of custom trading algorithms. This integration allows traders to implement complex strategies and execute trades automatically based on predefined criteria.

High-Frequency Trading

High-frequency trading requires a broker that can handle large volumes of trades with minimal delay. ADSS’s infrastructure is optimized for such activities, providing the necessary speed and efficiency. The broker supports advanced order types and conditions, which are crucial for executing high-frequency trading strategies effectively.

Options and Derivatives Trading

ADSS provides tools and support for trading options and derivatives, which are often used in advanced trading strategies. The platforms offer features that support complex options strategies, such as spreads and straddles. Additionally, the broker’s support for derivatives trading is robust, with tools designed to manage and analyze derivative positions.

Risk Management and Analysis Tools

Effective risk management and thorough analysis are essential for advanced trading, and ADSS provides a suite of tools designed to help traders navigate and optimize their strategies.

Risk Management Features

Effective risk management is essential for advanced trading strategies. ADSS offers customizable risk parameters that allow traders to set limits and manage their exposure effectively. The broker provides various margin and leverage options, enabling traders to adjust their risk profile according to their strategy.

Performance Analytics

Performance analysis tools are crucial for evaluating the effectiveness of trading strategies. ADSS offers detailed trade analysis and reporting features that help traders assess their performance. The platforms also include backtesting capabilities, allowing traders to test and optimize their strategies using historical data.

Customer Support for Advanced Traders

For advanced traders, robust customer support is crucial, and ADSS delivers specialized assistance to ensure a seamless and efficient trading experience.

Dedicated Support Channels

ADSS provides specialized support channels for advanced traders. This includes access to dedicated account managers and trading experts who can offer tailored assistance. The quality and responsiveness of customer support are crucial for resolving complex trading issues and ensuring a smooth trading experience.

Educational Resources

While the focus is on advanced trading, ADSS also offers educational resources that can be beneficial for professional traders. This includes webinars and tutorials on advanced trading techniques, as well as opportunities for personalized training. These resources can help traders enhance their skills and stay informed about the latest developments in trading strategies.

Conclusion

ADSS offers a range of features and support mechanisms tailored for advanced trading strategies. From robust platform capabilities and tools for algorithmic and high-frequency trading to comprehensive risk management and performance analytics, the broker provides a solid foundation for sophisticated trading activities. Their dedicated customer support and educational resources further enhance the overall trading experience. For professional traders seeking a broker that supports advanced trading strategies, ADSS presents a compelling option.

To learn more about how ADSS supports advanced trading strategies and to explore their offerings in detail, read a detailed review here.